It is an option to buy the shares of the Company at a future date and at a pre-determined price.

These plans are aimed at: –

Eligibility for ESOP (Section 2(37)): –

Applicable Provisions: –

Section 62 (1)(b) and Rule 12 of the Companies (Share Capital and Debentures) Rules, 2014

Approval of shareholders: – Private Companies: To offer ESOP, approval of shareholders by way of ORDINARY RESOLUTION* is required. (*Notification dated 5th June, 2015).

Other than the Private Companies:Approval of shareholders by way of SPECIAL RESOLUTION is required.

Important provisions: –

Disclosures in the Explanatory Statement (Rule 12(2)):

Method of valuation and a statement that the Company shall comply with the applicable AS.

Disclosure in Board’s Report (Rule 12(9)):

KMPs;Any employee who receives 5% or more of options granted during that year;Employees who were granted options of more than 1% of total issued capital during any one year.

Register to be maintained in Form SH-6 (Rule 12(10)):

Listed CompaniesWhere the equity Shares of the Company are listed, the ESOP shall be issued as per the SEBI Regulations.

Accounting & Valuation of ESOP

At the time of grant of option valuation of fair value of shares shall be done by registered valuer. At the time of exercise of option valuation shall be done by Merchant banker.

Fair value of shares at the time of “grant of Option” and “exercise of option” shall be done by registered valuer as per “Guidance note on accounting for employee share-based payment” (issued 2005).

Income Tax Act, 1961 does not specify any method for computation of FMV of shares but Section 17 and Rule3(8) of the Act provides that for the purpose of perquisite valuation the FMV of ESOP shall be such value as determined by a merchant banker on the specified date.

“Specified Date” means.-the date of exercising of the option; orany date earlier than the date of the exercising of the option, not being a date which is more than 180 days earlier than the date of the exercising.

The Issuing Company can claim ESOP cost as deduction.

Income Tax Appellate Tribunal in an order by (Dy. Commissioner of Income-tax (LTU), Bangalore Vs M/s. Biocon Limited) held that “discounts under the ESOP are an employee cost and should be allowed as a deduction over the vesting period, in the hands of the issuing company.”In an ESOP, the shares are issued to the employees at a future date (after vesting period) at price lower than fair market value (FMV) of the share.

Hence ESOP discount, is nothing but the reward for services, is a taxable perquisite to the employee at the time of exercise of option, and its valuation is to be done by considering the fair market value of the shares on the date on which the option is exercised.

|

ELIGIBLE |

NON-ELIGIBLE

|

||

| Applicable provision | Concerned Person | Applicable provision | Concerned Person |

| Section 2(34) | Director | Section 149(9) | Independent Directors |

| Section 2(59) | Officers | Section 2(69) | Promoter |

| Not defined under Companies Act, 2013 | Employees | Director who either himself or through his relative or through any body corporate, directly or indirectly holds more than 10% of the outstanding equity shares of the Company. | |

| Directors, officers or employees of the holding or the subsidiary company. | |||

| Applicable Provision, if any | Particulars | Explanation | |

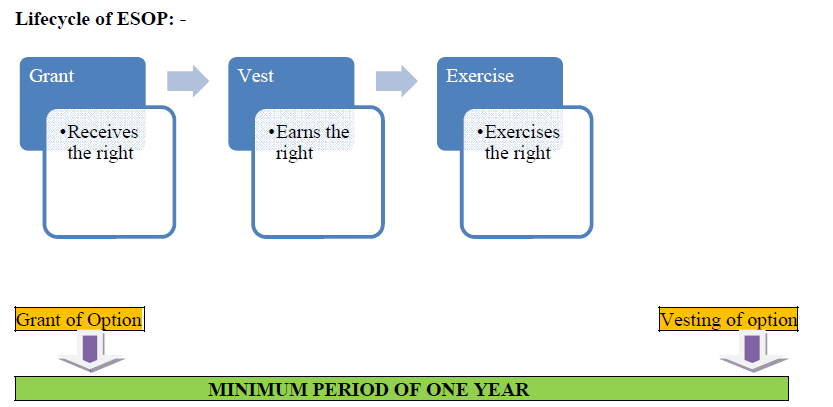

| – | Grant | Means the issue of options to Eligible Employees (explained above). | |

| – | Vest | Means the process by which the right to apply for Shares accrues to Eligible Employees against the Options Granted to them. | |

| – | Exercise | Means making of an application by an employee to the Company for issue of shares against vested options. | |

| Rule 12 (3) | Freedom to determine Exercise Price | Companies granting options to employees can freely determine exercise price in conformity with the applicable accounting policies, if any. | |

| Rule 12(4) | Separate Resolution | Required in two cases: -i. For granting options to employees of holding or subsidiary company; or

ii. For grant of option to identified employees, during one yearequal to or exceeding 1% of the issued capital at the time of grant of options.

|

|

| Rule 12(5)(a), (b) | Variation of the terms of the scheme | · Special Resolution required

· Variation should not be prejudicial to the interests of the option holders

· Notice for passing SR shall disclose the particulars of variation and rationale thereof.

|

|

| Rule 12(6)(b) | Lock in Period | The Company has the freedom to specify the lock in period for issued shares. | |

| Rule 12(6)(c) | Dividend/Voting Rights | The Employees will not enjoy the rights similar to members till the time shares are issued on exercise of option. | |

| The options granted shall | ü Not be transferableü Not be pledged, hypothecated, mortgaged or otherwise encumbered

ü Be exercised only by the employee to whom the option is granted. |

||

| Death of employee | If employee dies while in employment, all the options granted to him till date shall vest in the legal heirs or nominees of deceased employee. | ||

| Permanent Incapacity | If employee suffers permanent incapacity while in employment, all the options granted to him as on date shall vest in him on that day. | ||

| Resignation or termination of employment | All options not vested shall expire.

Employee can exercise the vested option subject to the terms of the scheme. |

||

Can Private Limited Company Issue Share to ESOP Trust at Face Value?

Can Unlisted Limited Company Issue Share to ESOP Trust at Face Value?

Dear Reader,

Please note, as per section 62 of the Companies Act 2013 read with Rule 12 of the Companies ( Share Capital and Debentures) Rules, 2014 (‘the rules’), a company other than listed company which is not required to comply with SEBI Employee Stock Option Scheme Guidelines shall not offer shares to its employees under a scheme of employees’ stock option (ESOP) unless it complies with the provision specified under the said rule. Notably, ESOP’s are issued to such ‘employees’ as a reward for the services rendered and/or value additions made in the company.

Hence, a company limited by shares can issue shares at face value under ESOP to only such specified employees and not to any other entity including a Private trust. In such a case, the company may opt for one of the options where they will issue shares to the trust and the said trust after the vesting period transfer such shares to beneficiary employees.

Can you please tell me where it is written that such shares can be issued at face value and not below them?

Dear Reader,

Pursuant to Section 53 of the Companies Act, 2013 (“the Act”), no company shall be allowed to issue shares at a discount except as provided under Section 54 of the Act i.e., issuance of Sweat Equity Shares.

Further, as per Black’s Law Dictionary “Discount share” means a share issued for less than par value/face value/nominal value. Thus, the meaning of discount should be taken into account with relation to face value of the share only.

Hence, the Company shall be not be allowed to issue shares under the scheme of ESOP at a value less than the face value.

Valuation is required, if esop option grant at face value?

Dear Reader,

Pursuant to section 62(1)(c) of the Companies Act, 2013 read with Rule 12(3) of the Companies (Share Capital and Debentures) Rules, 2014the Companies have freedom to determine the exercise price in conformity with the applicable accounting policies, if any.

Further, per Guidance Note on Accounting for Share-based Payments issued by the Institute of Institute of Chartered Accountants of India, valuation is required to determine the fair value/ intrinsic value, as the case may be, at the time of grant of option by an independent valuer in case of an unlisted company. In case of a listed company, fair value/intrinsic value is calculated based on the market price of the shares.

Furthermore, valuation is also required at the time of exercise of option by a merchant banker as per taxation laws to calculate the value of perquisites, in case of an unlisted company. In case of a listed company, the value is determined based on the market price at the time of exercise of option.

Thus, valuation report is not required under the Companies Act, 2013. However, the same is mandatory for an unlisted company to comply with the accounting and taxation laws.

Is it mandatory to amend AOA to issue ESOP’s. if yes, where is this requirement given?

It is not mandatory to amend the AOA of the Company to issue ESOP, but you have to comply with the provision of Rule 12 of the Companies (Share Capital and Debenture) Rules, 2014.

For more details, you can refer to our blog on ESOP (https://bsamrishindia.com/a-brief-on-employee-stock-options-plan-esop-in-india-by-a-private-limited-company/).

Can a consultant be issued ESOPs by a foreign company?

ESOPs can be issued to employees. Further, as per Rule 12 of the Companies (Share Capital and Debentures) Rules, 2014, ‘employee’ for the purpose of ESOP means a permanent employee of the company or its’ subsidiary. The definition does not include “Consultant” and hence a consultant cannot be issued ESOP

Can you provide the process of registering a ESOP Trust for a private company?

A Trust required to create for implementing ESOP shall be Private Trust, A Private Trust is governed by Indian Trust Act, whereas Public Trust (NGO or Charitable Trust) is governed by state legislation. Any Person who is competent to contract can form Trust.

• For formulating private trust create the proper trust deed and get the same register with the Local Registrar under the Indian Trusts Act, 1882 with the following requirements to be fulfilled:-

1. Trust deed on stamp paper

2. One passport size photograph and copy of the identity proof of all the trustees

3. One passport size photograph and copy of the identity proof of the settler

4. One passport size photograph and copy of the identity proof of the witnesses (at least two)

5. Settler’s signature on all the pages of the deed

6. A copy of income-tax registration is also needed.

Although in case of ESOP by Private Companies, the Direct Route is suggested to follow as it is simpler to follow and implement.

Sir, One works for an indian private company. The company has given stock options to the employee. However the stock options are of the parent company which is a foreign private company. These stock options are vested but not exercised. How should they be disclosed in ITR. Should they be disclosed at all in “Foreign Assets” given that they are only vested but not exercised and hence the acquisition cost is zero.

The obligation to disclose “Foreign Assets” in ITR arises only when the options are exercised. In your case, the options are only vested and not exercised, therefore it will not be reported in ITR as “Financial Asset”.

Sir, like to know, if employee has been terminated with out cause and CEO/founder committed via email to extend the exercise date by making changes to the scheme but did not issue the letter. What is the legality at the time of merger of such options vested and are not yet exercised

If you have already vested your rights, then you can exercise those vested rights as per terms & conditions of the scheme, even after your termination.

We suggest you to obtain professional advise on the basis of specific facts i.e. terms & conditions of the scheme, employment terms etc.

Really nice article

Can esops be granted to independent directors of a private company which obviously is not listed? If not how do you compensate the independent directors of a private company?

No. Independent directors (ID) are not entitled to hold shares in the company (including ESOPs). IDs can be compensated for their services as follows:

1) Sitting fees to attend board/committee meeting as approved by the Board. But, not less than amount payable to other directors and max. INR 1,00,000/- per meeting.

2) Reimbursement of expenses (in actual) to attend board/committee meetings.

3) Profit related commission as approved by the Board.

Sir, once the esop is vested and exercised by an eligible employee, then are the shares transferred by the esop trust to the employee or the employee becomes beneficial owner in the shares and the trust remains the legal owner. Please let me know. Many thanks

Once the options are exercised, the trust transfers the shares to the employees and such employee gets all the rights available to a member. Therefore, the employee becomes the Registered/Legal as well as Beneficial owner.

Can a company have different schemes for different rank of employees?

By different schemes, do you mean the different perquisites for different ranks? If so, yes, it can be done.

For the purpose of Section 62(1)(b) and Rule 12 of Companies Act,2013.

“Employee” means –

a. A permanent employee of the company who has been working in India or outside India; or

b. A director of the company, whether a whole time director or not but excluding an independent director; or

c. An employee as defined in clause (a) or (b) of a subsidiary, in India or outside India, or of a holding company of the company or of an associate company, but does not include-

i. An employee who is a promoter or a person belonging to the promoter group; or

ii. A director who either himself or through his relative or through any body corporate, directly or indirectly, holds more than 10% of the outstanding equity shares of the company.

Dear Sir,

An unlisted company has issued ESOPs thru Trust. My question is that whether the company should get ESOP Trust registered. If yes, is it mandatory?

Registration of ESOP Trust is not mandatory though it is beneficial considering the following points:

• Easy conveyance of trust-property to the Trustee and thereby easy conferment of shares to Employees part of the ESOP

• It becomes an official document with support and law

• The registered Trust Deed can be used as an documentary evidence

If options for more than 1% of the issued capital granted without passing Special Resolution what are the consequences?

How it can be regularised now?

Can it be exchanged with less no of options with no change in terms of grant?

This query requires considerable research. Please connect for professional advice.

1.how can an employee of a private company sell his ESOP shares ??

2.when he needs to pay the ESOP amount if vesting period is 1 year???

3.how could a private company finalize its FMV price??

1. The employee can sell esop shares provided that the lock in period has been eloped and any other conditions as specified.

2. The amount is required to be paid at the time of exercising the option.

3. There are different methods available in the market. A company can choose what is best suitable for it.

. There is no ready market for shares of a Pvt Ltd Co. unlike listed companies. Marketability of such shares are generally discussed at the time of launch of the scheme and generally promoters come forward with assurances and commitment through scheme document.

2. The amount is required to be paid at the time of exercising the option. The ESOP scheme would contain details.

3. There are different methods available in the market. There is no specific methodology prescribed.You need to go through the details of the ESOP Scheme, it would provide guidance as to valuation as well.

What happens to an employees non-vested shares in the case of an investment? For e.g. an employee who has vested 75% of their options and a Series A investment happens of 30%, what happens to the employees remaining 25% non-vested shares?

As per our limited understanding, there is no relation between Series A investment and the percent of shares vested. So, remaining non-vested shares will be treated as per the scheme of ESOP approved by the members.

Sir,

I have some doubts regarding ESOP to a private limited company.

1. When the employee has not exercised the option within the specified period, can the company extend the period by passing any resolution.

2. If so, what is the compliance procedure, accounting treatment and tax implication for the Company on the date of Extension.

3. Does the company required to obtain Valuation report as on date ?

Companies Act 2013 does not provide anything on extension of ESOP. As per our understanding, if employee has not exercised the option and you wish to give that option again to that employee then you have to repeat the entire process. Valuation report shall be required in case of ESOP.

sir

if a director belong to promoter or promoter group can participate in esop scheme

As per Rule 12 (1)(C)(ii) of Share capital and debenture rules 2014 “a director who either himself or through his relative or through any body corporate, directly or indirectly, holds more than ten percent of the outstanding equity shares of the company cannot participate in ESOP.

Sir

Like to know if 5% cap on issue of ESOPs applicable on issue of Phantom stocks also, for a private company too?

Companies Act, 2013 has prescribed rules for issuance of shares to employees under ESOP & ESOS, it is silent on the grant and exercise of Phantom Stock Options. As we searched on the net for the meaning of phantom stock, this is what we found. A phantom stock plan is an employee benefit plan that gives selected employees (senior management) many of the benefits of stock ownership without actually giving them any company stock. This is sometimes referred to as shadow stock.

Phantom stocks by a private company is not specifically guided under the said Act.

Can a company whose authorized shares are fully issued can exercise ESOP?

What are the steps to increase authorized capital.

And at what price ESOP can be issued?

“No, if the authorised shares of the company are fully issued, it has to increase the authorised capital before the rights are exercised by the beneficiary.

For increasing the authorised capital, follow the provisions of sections 61 and 64.

Price of ESOP-As per rule 12(3) of Companies (Share Capital and Debentures) Rules, 2014, the companies granting option to its employees pursuant to Employees Stock Option Scheme have the freedom to determine the exercise price but complete disclosure is required to be made with regard to the pricing method used in the explanatory statement annexed to the notice for passing of the special resolution by the shareholders.

“

yes company can excersie esop but before the stating of exercise time period start company should purchase the share from the market as per sec 167 and thererule

for this purpose generally a trust created and full disclosure regarding the trust mention in the notice and proper resolution also pass to authorize the trust

Sir, ESOPs which are vested and not exercised by employees can be bought back under section 68 (buy back)

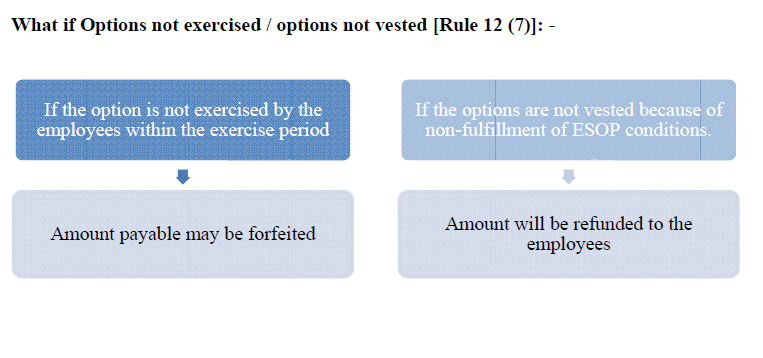

“We regret the late revert to your query. Stock- Options which are vested but not exercised cannot be bought back.

However, as per Rule 12 Share Capital and Debentures) Rules, 2014 the option may be forfeited by the company if the option is not exercised by the employees within the exercise period.

“

Is there any ROC Form that need to be filed after grant of option?

In accordance to Rule 12 of The Companies (Share Capital and Debentures) Rules, 2014. You are required to pass a special resolution and you need to file

• MGT 14 within 30 days of passing the Special resolution

• PAS 3 as Return of Allotment within 30 days of passing the Special resolution

• A disclosure in regard to the same shall be in the board report

Dear Sir

Hope u are doing well.

I am handling ESOP assignment, and after reading this question i have some doubts in my mind, please clear:

1. Whether employees are required to pay share application money at the time of Grant Letter or at the time when company do allotment after excersing of right options by the respective employees?

2. when special resolution need to be passed : (a) before grant of right to the employees (Grand Letter)?

(b) when company plans for allotment after excersing the right by the employees?

Response at the earlist will help me a lot. Thanks

1.Employees are required to pay share application money at the time of Grant Letter.

2. a) Yes, special resolution is to be passed before the grant of right. Once an ESOP scheme is approved , a Letter Of Grant should be issued to the employees.

2. b) the company can make the allotment immediately after the rights are exercised by the employees.

Allotment of shares to Nominee.

Dear sir

In case if Foreign holding company issued ESOP to the employees of unlisted subsidiary company. who will do the accounting of ESOP

holding or subsidiary

As per Rule 12(1)(c) of (Share Capital and Debentures) Rules, 2014, ESOP can be issued to an employee of a subsidiary company in India. In such a case, holding company will do the accounting of ESOP and holding company being a foreign company, it needs to follow the rules directed by its governing body.

Hello Sir,

Do we need to file any forms with MCA in case of private limited company.

As per Sec. 62(1)(b) of Companies Act 2013, Private Co. going for ESOP scheme will need to file e-form PAS-3 (Return of Allotment), and it is filed as and when options are exercised by the employees and shares allotted to them by the Board of Directors.

In case there is a requirement to increase authorised capital of the Company, when shall it be increased? at the time of grant of option or on exercise of the option or on vesting itself?

The authorized share capital may be increased at any time before allotment of shares.

Whether a private company can issue further Esop’s to an M.D ALREADY HAVING 8.23% EQUITY SHARES AND 3% srtock options which is exceeding the limit of 10% outstanding equity shares to be ineligible?

As per Rule 12(4) of the Companies (Share Capital and Debentures) Rules, 2014, special resolution is required to be passed for grant of option to identified employees, during any one year, equal to or exceeding one percent of the issued capital (excluding outstanding warrants and conversions) of the company at the time of grant of option.

Should a private company open a separate bank account for accepting share application money during exercise of esop’s untill allotment

Issuance of ESOP is regulated by section 62(1)(b) of companies Act,2013 there is no such requirement given under this section for opening separate bank account Hence money received under ESOP can be kept in the normal bank account of the Company.

Does this guidelines also applicable to Equity Settled stock appreciation scheme of an unlisted company? Since company law is silent on the SAR.

As per SEBI (Share Based Employee Benefits) Regulations, 2014, the guidelines of SEBI shall not be followed in case of Equity Settled stock appreciation scheme of unlisted Company. These regulations are meant for listed company only.

Are SEBI (SBEB) Regulations applicable to a subsidiary of listed company issuing ESOPs? If not, are there any other SEBI regulations concerning the same.

No, SEBI (Stock Based Employee Benefit) Regulations, 2014 are not applicable to a subsidiary of listed company issuing ESOPs. It shall comply with the Companies Act, 2013.

Hi,

My employer offered me 25,000 as a bonus linked to ESOP. But it is written only in the appraisal document. No other details given like vesting period, how many shares etc., I havn’t got any documents regarding that, how can I claim that?

There is a proper procedure to issue ESOP shares, as in your case it seems that

• no procedure has been followed for the ESOP

• no shares are disclosed

• simply offer of an amount as bonus linked to ESOP can’t be considered as ESOP

• company have to provide grant of option, vesting of option and exercise of option period.

What are the compliance’s a private limited company needs to do in case of grant of ESOP options. However, these grants are exercisable at the time of liquidation of the company. Please help.

As per section 62 read along with rule 12 sub rule 6(a) of Companies (share capital and Debentures) Rules 2014 there shall be minimum gap of one year between the grant of options and vesting of options. Once shares are granted they can be exercise by ESOP holders once vested, at any point of time as mention in the scheme.As per our understanding, there is no prohibition to exercise the option if company is in liquidation.After Liquidation life of company comes to end.

Dear Sir,

Can we issue share under ESOPS at face value.

Please let me know.As Company act says Company has discretion to determine price.

ESOPS can be made at any price not less than the face value.

Can you please provide specific provisions which provide for non issuance of ESOP at price below face value

Section 53 of the Companies Act, 2013 says that except as per Section 54 of the Act, the company shall not issue shares at a discount to face value and Section 54 talks about sweat equity shares only.

In our case, our’s is a private limited company. ESOP scheme implemented (Incl. nomination forms)..options granted and vested. thereafter Employee died. At the time of allottment of shares against options exercised…does the company required to obtain valuation report..? Can it obtain valuation report from Statutory Auditor or any other Independent Auditor.?

Or

Is it compulsorily to obtain valuation from merchant banker, for Pvt ltd company…will you please quote relevant provisions thereof…?

Procedure for allotment shares to nominee

As per the provisions of the section 62(1)(b) of the Companies Act, 2013 read with Rule 12 of the Companies (Share Capital and Debenture) Rules, 2014, In the event of the death of employee while in employment, all the options granted to him till such date shall vest in the legal heirs or nominees of the deceased employee.

Valuation report is mandatory in case of ESOP. Valuation shall be done (Fair value of shares) at the time of “grant of Option” and “exercise of option” by registered valuer as per “Guidance note on accounting for employee share-based payment” (issued 2005) and pursuant to the Rule 40D of Income Tax Rules ,1962 which provides that FMV of ESOP shall be as determined by a merchant banker on the specified date.

Specified Date” means.-the date of exercising of the option; or any date earlier than the date of the exercising of the option, not being a date which is more than 180 days earlier than the date of the exercising.